What we’ve seen so far?

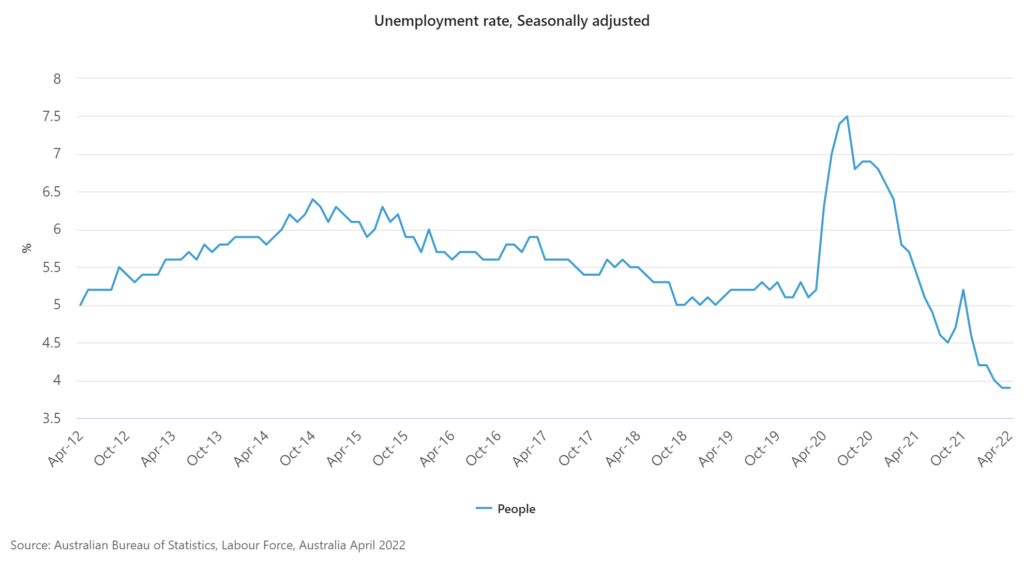

- The 2016 Census recorded low unemployment and underemployment rates, with a marginal drop from that of previous years.

- Unemployment rates have continued to be on the low since the 2016. While unemployment soared in the wake of Australia’s border closures, the economy witnessed a quick recovery with employment bouncing back to near pre-Covid levels.

- In light of the recurring lockdowns in 2020 and 2021 and the return of the international workforce back to their home countries, the available casual /part time workforce contracted.

- Underemployment rates followed a similar trend to unemployment rates since the last Census. While it’s promising that underemployment rates are expected to fall further, job creation has remained stagnant.

- While employment participation rates among men are expected to remain stable or witness a marginal increase, female participation rates are expected to see a more significant overall rise from the 2016 Census.

- The impact of COVID-19 has had a very uneven impact on industries:

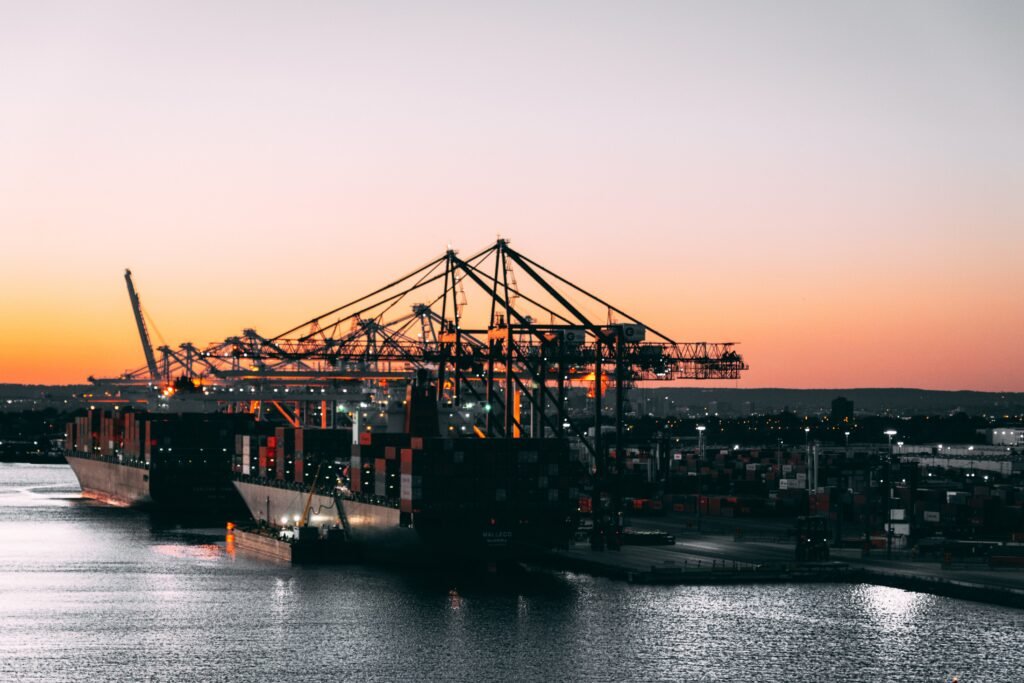

- The freight and transport industry emerged as winners

- Hospitality and tourism were particularly hard-hit. The disruption caused by the pandemic meant that many people were forced to change careers, shift jobs etc., hence the demand for careers in these industries drastically waned as the pandemic receded.

What to expect?

- The persistence of the pandemic and its impact is likely to continue signalling labour shortages in key industries like healthcare, aviation, and hospitality in the upcoming years.

- Wage growth is forecasted to see an uptick considering the slow recovery in inward migration and the limited domestic supply of labour force, with the Fair Work Commission increasing the minimum wage by 5.2%. The increased cost of living has also led to more bargaining.

- The significant disruptions to global supply chain systems are predicted to boost the local manufacturing industry. However, local food supply chain issues due to the floods in NSW and Queensland may cause potential concerns in the long run. Domestic tourism may also recover more quickly due to ongoing concerns about overseas travel.

To find out more about what the 2021 Census Data means for you and your business, stay tuned to this page!