Over 3,000 Melburnians crossed the Yarra River to call Wyndham home

The second series release of the ABS 2021 Census has arrived and one of the datasets that we enjoy exploring is the internal migration. This gives us some understanding of the scale of migration and where people are going. If you have been following our Census 2021 blog series so far, we explored the fastest growing Local Government Areas around Australia. In Victoria, this happened to be in the City of Wyndham. During the inter-Censal period, Wyndham went from 217,118 i 2016 to over 292,000 people by 2021 – a gain of nearly 75,000 new residents!

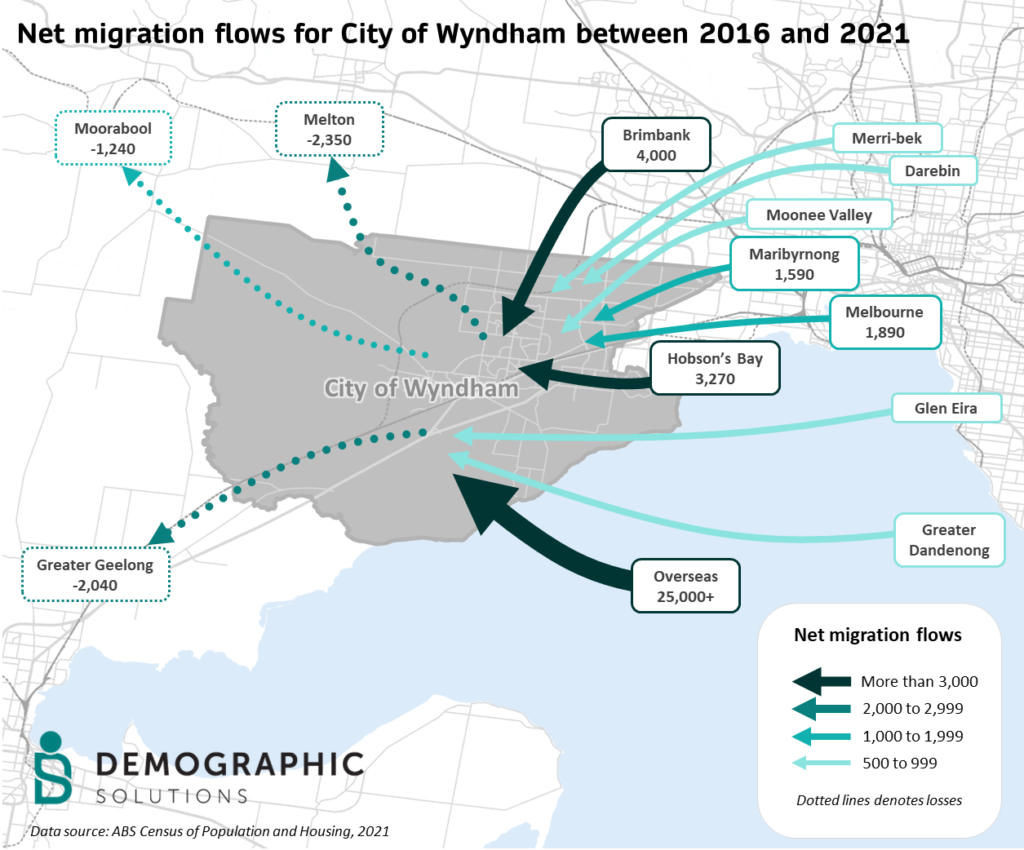

The migration map below shows the most significant net flows of people to and from the City of Wyndham between 2016 and 2021. As expected, Wyndham gained most of its new residents from neighbouring LGAs, most notably, Brimbank and Hobson’s Bay. It also gained an estimate of over 25,000 people from overseas. Interestingly, however, over 3,000 new residents emerged from “across the Yarra” – calling Wyndham home by 2021, with the most significant net gains in population from Glen Eira (+860), Greater Dandenong (+790), Port Phillip (+480) and Stonnington (+480).

All LGAs in Melbourne had population growth, although the fastest rates of gain were on the fringe. The growth in these areas was driven by high rates of greenfield residential development in new estates, with Wyndham at the forefront of development to 2021. Development companies (large and small) have been significant players in providing a range of products from affordable housing to developments aimed at mature families.

While all suburbs in Wyndham experienced some growth, the most significant development fronts in Wyndham occurred in the following areas:

- Tarneit: First home buyers’ market with multiple development fronts notably Emerland Park Estate (Grassylands Pty Ltd), Newgate Estate (Central Equity Limited), Orchard Tarneit (Dahua Group Australia), Rothwell Estate (Dacland) and The Grove (Fraser Property Group).

- Truganina: First home buyers’ marekt Allbright Estate (Villawood Properties), Elements Estate (ID_Land) and Westbrook Estate (Dennis Family Corporation) being the most prominent during this period.

- Werribee: Most significant development fronts include Harpley Estate (Lendlease) and Riverwalk Estate residential component (Development Victoria) aimed at the affordable housing market.

- Wyndham Vale: Mixture of first home buyers and mature families with significant developments being the Jubilee Estate (Lotus Living), Manor Lakes Estate (Dennis Family Corporation), Savana Estate (AVID Property Group) and Wynbrook Estate (Dacland).

- Point Cook: Generally aimed at more established families, the area is entering its development swansong, but still had large new development area at the west and south-east, including the commencement of Upper Point Cook (Satterley Property Group).

During this period, Wyndham also experience some notable losses to neighbouring LGAs, namely Melton, Greater Geelong and Moorabool. These LGAs also experience significant broadhectare development during this period. There are few other significant net outflows, but interestingly, the next largest losses were to the next ring of regional LGAs including Golden Plains (-440) and Ballarat (-387).

As demand for affordable housing on the fringe continues,Wyndham will play a significant role as a place for new families into the next decade. However, it is likely that Wyndham will pass on the baton to Melton as the fastest growing fringe LGA in the next five years, with residential development ramping up across Melton.

Stay tuned to our blog page for more insights and analysis on the 2nd release!