Much has been spoken about the changes in development patterns across Australia due to the COVID-19 pandemic. In this article, we analyse dwelling growth in New South Wales and Sydney to discover how development patterns have changed over the last three Census periods.

How did we do it?

We have allocated all ABS SA2 geographies in Sydney and Regional NSW in 2021 to a series of categories:

- In Sydney by sector (inner, northern, south-western etc.) and ring (inner, outer etc.)

- In regional NSW by size of settlement, areas along the coast, areas around Sydney and remaining areas

SA2s were allocated for 2016 and 2011 and ABS State Suburbs in 2006. Where SA2s or State Suburbs did not conform to 2021 geography over time, areas were split to ensure comparability.

What do the results show?

The results indicate that development has been increasing across NSW over the last 15 years, with increases of 43.4% during the 2011-16 period compared to 2006-11 and 52.9% during the 2016 to 2021 period compared to 2011-16. In all regions, there was significantly more development occurring in the 2016 to 2021 period. This was not true for all ring / typology areas, with inland regional areas remaining relatively stable in dwelling gain across all three inter-censal periods. Metropolitan Sydney experienced widespread increases in residential development, with incredible growth in North-Western and South-Western Sydney, based on a marked acceleration in greenfield development in the growth corridor areas. Places such as Marsden Park, Kellyville, Jordan Springs (North-West) and Oran Park, Leppington and Edmondson Park (South-West) have emerged as new suburbs over this time period. See table below.

Dwelling additions by NSW region, 2006-2021

While net dwelling growth has increased, the share of dwelling additions across NSW has changed considerably, with certain regions increasing their shares and others falling over time. For much of Sydney’s history, the outer and fringe suburbs have played a major role in housing Sydney’s growth. However, for the last thirty years, it has been State Government policy to make greater use of existing transport and social infrastructure in existing areas by promoting more residential growth in established areas. In particular, the Government has promoted higher residential densities around major transport nodes and the redevelopment of many old industrial areas for housing, such as Green Square, Breakfast Point and Meadowbank.

The comparative ‘remoteness’ of new greenfield areas to the Sydney CBD is another factor that has provided impetus for greater growth in established areas. Major suburban employment nodes have emerged across Sydney in places such as Parramatta, Liverpool, Castle Hill, Chatswood, Macquarie Park, which in turn have supported complementary medium and high-density residential growth.

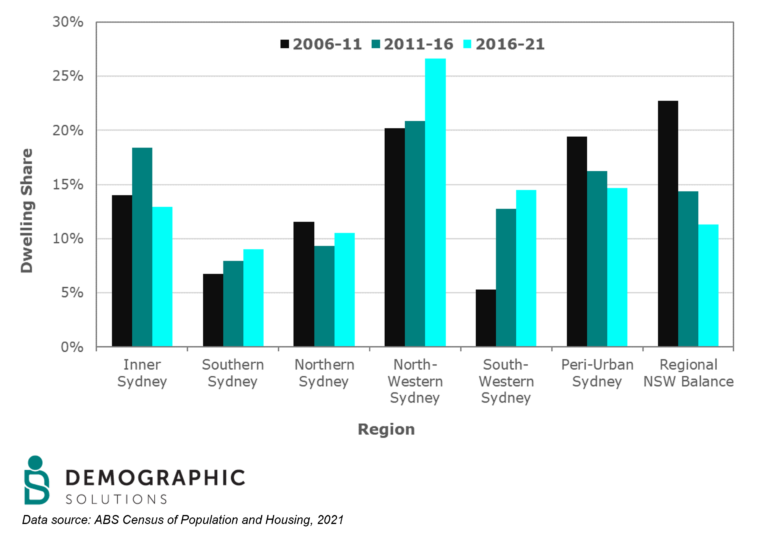

During the 2011-16 period, the share of growth in the inner region was at its zenith, with almost 1 in 5 additional dwellings in NSW occurring in the region. Undoubtedly, uncertainty associated with the closure of the international boundaries would have dampened dwelling growth in the period leading up to August 2021, with such a large share of Inner Sydney catering for persons from overseas (both tertiary students and other visa holders). While Southern and Northern Sydney have generally continued to keep pace with the overall increase in dwelling production (Southern Sydney’s share growing slightly), there was a huge increase in share in South-Western and North-Western Sydney. These increases are heavily associated with the boom in greenfield development, especially in the 2016-2021 period. This trend is in great contrast with the pattern over the past few decades, where more of Sydney’s development has been in established parts of the metropolis. These increasing shares have generally come at the expense of regional areas, especially rural areas beyond the urban fringe of Sydney, with the Regional NSW Balance falling from 22.7% of dwelling gain in 2006-11 to just over 11% in the 2016-21 period. See figure below.

Share of dwelling additions by NSW region, 2006-2021

While the pandemic may have had the effect of allowing people to change their work habits in NSW by allowing people to work remotely, the effect has been minimal on dwelling production. Indeed, if anything the trend in NSW has been very different to Victoria, with the overwhelming growth occurring in Sydney, from middle suburbs to fringe areas.

The share of development has been falling in regional centres, despite continued strong development numbers. This contrasts with development in coastal areas, which remained quite stable in the 2016-2021 period, having fallen significantly in the previous inter-censal period. As highlighted previously, inland rural areas and towns have experienced a large fall in the share of NSW development. The one typology area outside of Sydney that has remained stable in terms of development share is the Newcastle and Wollongong region. It highlights that these major cities are continuing to attract migrants from Sydney, as well as overseas. See Chart below.

Share of dwelling additions by Sydney Ring / Regional Typology Area, 2006-2021

It should be noted, however, that the share of development does not necessarily equate to population growth. A number of inner areas of Sydney actually decrease in population between 2016 and 2021, while most areas of regional NSW grew moderately to strongly in population between 2016 and 2021.

Where to from here?

Inner Sydney is again set to increase share with the re-opening of the international borders and some level of post-COVID-19 normality returning. Middle suburbs are likely to maintain share in the short-term to medium term, but some centres may struggle to maintain high rates of development in the longer term, as the larger and less complicated sites become developed. Development potential in the outer ring of suburbs is already strong, but these areas still have significant untapped development potential. Some further changes to the planning regime may have to occur to facilitate growth.

Fringe development may slow in response to the new higher interest rate environment. However, in the longer term some changes will inevitably occur across and within regions as development fronts are exhausted and others commence. The North-West Growth Corridor is being developed at quite a pace and there is limited development potential in the region beyond 15 years. While there is additional greenfield potential in the west and north-west of Sydney, not yet earmarked for residential growth, the recent flooding events in Western Sydney highlight the need for a cautious approach to planning. While development in regional areas remains strong, the share has fallen over time, suggesting lower demand for living in these areas compared to previous time periods. This pattern is in stark contrast to the residential development trends in Victoria, where regional areas have tended to keep pace with Melbourne.