It is fairly well known that over the past decades, home ownership rates have fallen, while the proportion of Australians renting has increased. This shift has also seen changes in the dwelling stock composition of Australia, with an ever-increasing share of households living in apartments and medium density dwellings as apartments are relatively more affordable and often in more desirable locations.

Today, we wanted to dive deeper into the data to reveal the factors affecting rental rates across the country. Those familiar with the metropolitan areas of Australia are likely aware of the impact of the property investment industry, rising living costs and the need for dwellings in locations which are more accessible to city centres.

However in uncovering the spatial data for this blog, we realised this can become an important conversation in the discussion of injustices towards Indigenous Australians, the need to apply a degree of nuance to discussions around home ownership/rental rates, and the how facets of a situation are often missed by conventional media outlets.

The Australian Dream?

The “Australian Dream” has been characterised by the desire to own a free-standing house, with a back yard and ample space for the kids. Compared to other countries, Australia is seen as a country where you can afford to have space, and a good place to raise a family. Conversely, renting is seen as a transitional stage, with 12 month or short-term leases as the norm.

However, this view of the “Australian Dream” is not always achievable, particularly for Australians who have been able to own property and build their wealth.

Rental Rates Across the Country

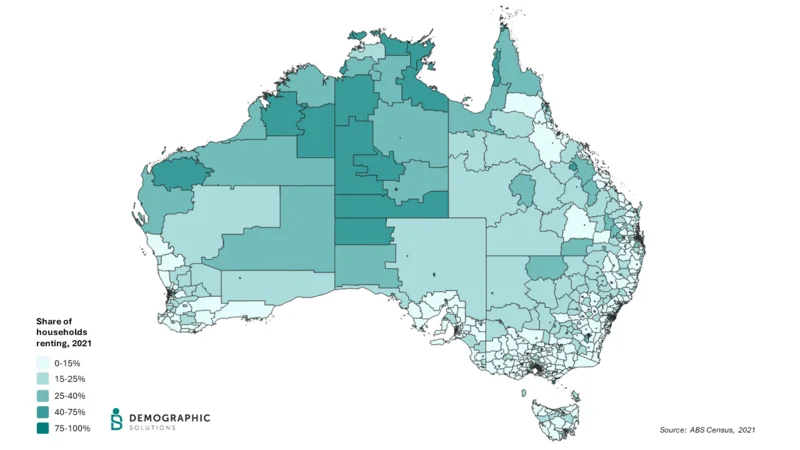

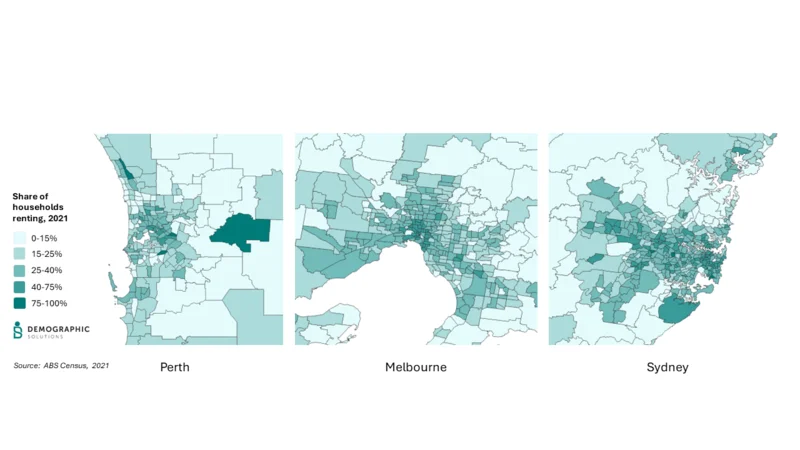

Today, the Australian Dream is alive and well in most parts of the regional fringes of metropolitan cities with the inverse being true in the inner and suburban part of major cities.

Rates of renting are high in the major cities, following a radial pattern from city centres. However, rental rates across the Northern Territory and the north of Western Australia are also high for different reasons compared to the major cities.

Let’s talk about the Northern Territory

The data suggests that Australians in the Northern Territory have higher labour force participation and a higher proportion of individuals receiving government allowance. Despite higher median mortgage repayments, households are experiencing similar levels of mortgage stress compared to the typical Australia. So what explains these trends?

Indigenous Insights

Taking a deeper dive into the demographics of the Northern Territory, we see that approximately 30% of residents are estimated to be of an Aboriginal and/or Torres Strait Islander background in 2021.

A reason for the high rates of renting is due to land use and ownership rights, which give Aboriginal and Torres Strait Islander communities leasing options over individual lots and township over communities. This means that many leases are held by organisations rather than individuals, contributing to the higher percentage of households renting (see CAEPR 2021, Leasing Reforms on Aboriginal Land in the Northern Territory: Impacts on Land Rights and Remote Community Governance).

Additionally, systematic discrimination from education and employment opportunities have made it difficult for Indigenous Australians to build to necessary wealth to own a home. These factors also have repercussions on the next generation, with fewer role models for children to base their educational or career aspirations upon and less intergenerational wealth to pass on.

Whether home ownership should be used as an indicator of living standards and wealth across cultures which traditionally may not rely on the same metrics is debatable, however in the current day and age it is still an important indicator, with “a safe, secure home with working facilities… essential for good health and wellbeing”.

A Territory of Transience

Another explanation for both the high rental vacancies and higher income levels can be found in the Northern Territory’s role as a state for career progression, with many Australians moving temporarily to the state without intentions of buying property.

These jobs include defence positions and jobs in the mining industry, which are both transient but attractive for their pay and/or opportunity for career progression.

A Seldom Told Story

You may notice that these explanations are very different from factors typically discussed for rental rates in metropolitan regions and around city centres. In addition to housing affordability and cost of living pressures, discussions around the rate of renting typically revolves around the differences across each generation or age bracket. This is an important conversation, but one which is prone to leaving behind and failing to acknowledge the stories of certain groups.

The Takeaways

Ultimately, we want to use our geographical analysis to shed light on a different facet of the home ownership/rental rate discussion.

Although Australians enjoy high standards of living with upward mobility, it is still important to recognise the impacts that generational wealth and policy can have on a population, in addition to recognising how past policy has shaped the lives of Indigenous Australians in the past, present and future.

Found this blog interesting? You may also be interested in: